ISC Credit

Seamlessly Integrated Credit Reporting

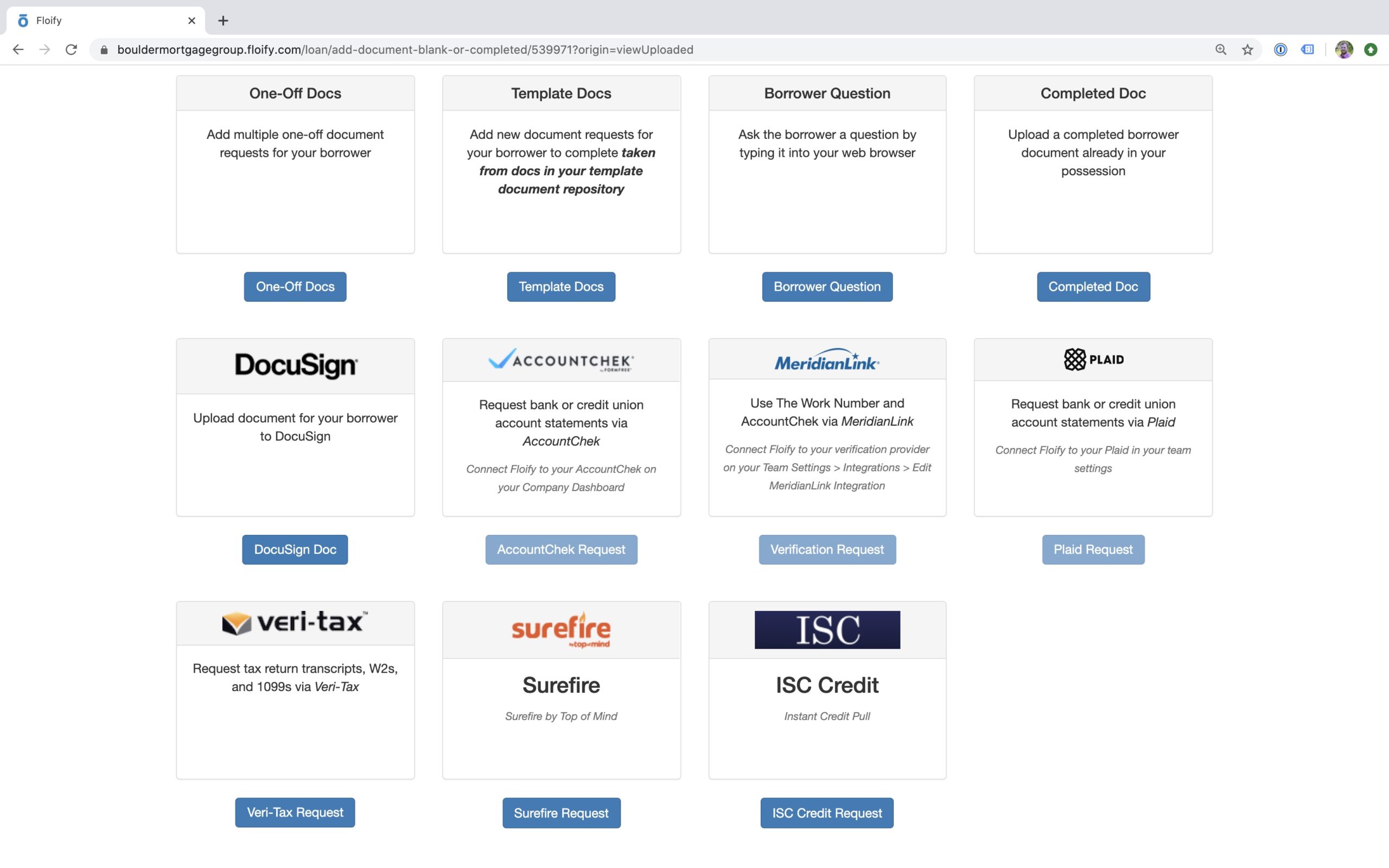

Floify's integration with the ISC Credit reporting solution enables loan originators to quickly and easily get validated applicant credit information directly within Floify by leveraging the originator's existing ISC Credit account.

Setting up the integration in Floify requires just a single-click to enable, and then the originator's account credentials are entered and subsequently stored for future use on the ISC Credit order form.

Once the integration setup is complete, a credit pull can be initiated on-demand from a Floify loan flow. Additionally, loan teams can configure the integration to automatically pull a borrower's hard or soft credit report upon the submission of a Floify 1003 loan application.

The ISC Credit integration takes advantage of Floify's built-in credit authorization functionality, which empowers borrowers to digitally submit their consent to originators in just a few clicks.

After credit has been ordered, the full tri-merged report will be delivered to the yellow bucket of the corresponding Floify loan flow within moments and is viewable only to the loan originator and lending team for processing.

About ISC Credit

At ISC, we provide credit report solutions necessary for mortgage brokers and lenders to close loans efficiently and in a timely manner. We understand that customer service is just as important as results, that is why we set the standard in our field. Let us help you achieve your goals.

Established in 1989, ISC has strived to provide the necessary tools for Mortgage Lenders, Mortgage Brokers, and Property Management companies in their line of work while aiding them in achieving their goals. ISC raises the standard in customer service. We keep our clients as our top priority. ISC customers benefit from fast turnaround times, competitive pricing, and live experienced representatives with every phone call.

For more information, please visit isccredit.com.