Task Management: Massively Improve Team Efficiency with Floify’s Latest Time Saver

Floify's Task Management feature is a massive time-saving update for processors, LOAs, closing coordinators, and other loan origination support staff. By streamlining the workflow for these critical users, mortgage lenders and team leaders can instantly boost the effectiveness of their workforce – a necessity in a market environment where tight margins are driving low loan profitability for organizations.

Make Your Critical Support Staff More Efficient and Effective

Floify's Task Management works by providing mortgage companies with the tools they need to define an individual's role and then assign the right people to work on each loan flow, at the right time.

Additionally, when processors, LOAs, closing coordinators, and others access Floify, they will have the ability to view a dashboard that only displays the loan flows that have been assigned to them.

This combination takes the guesswork out of the day for users. Support staff is able to save a ton time that has been traditionally spent navigating between dashboards to find and access the necessary loan files. Now, with Task Management in Floify, support staff users will be able to touch more files and get more done every day.

Save Even More Time by Automatically Assigning Staff to Loan Flows Using Conditional Logic

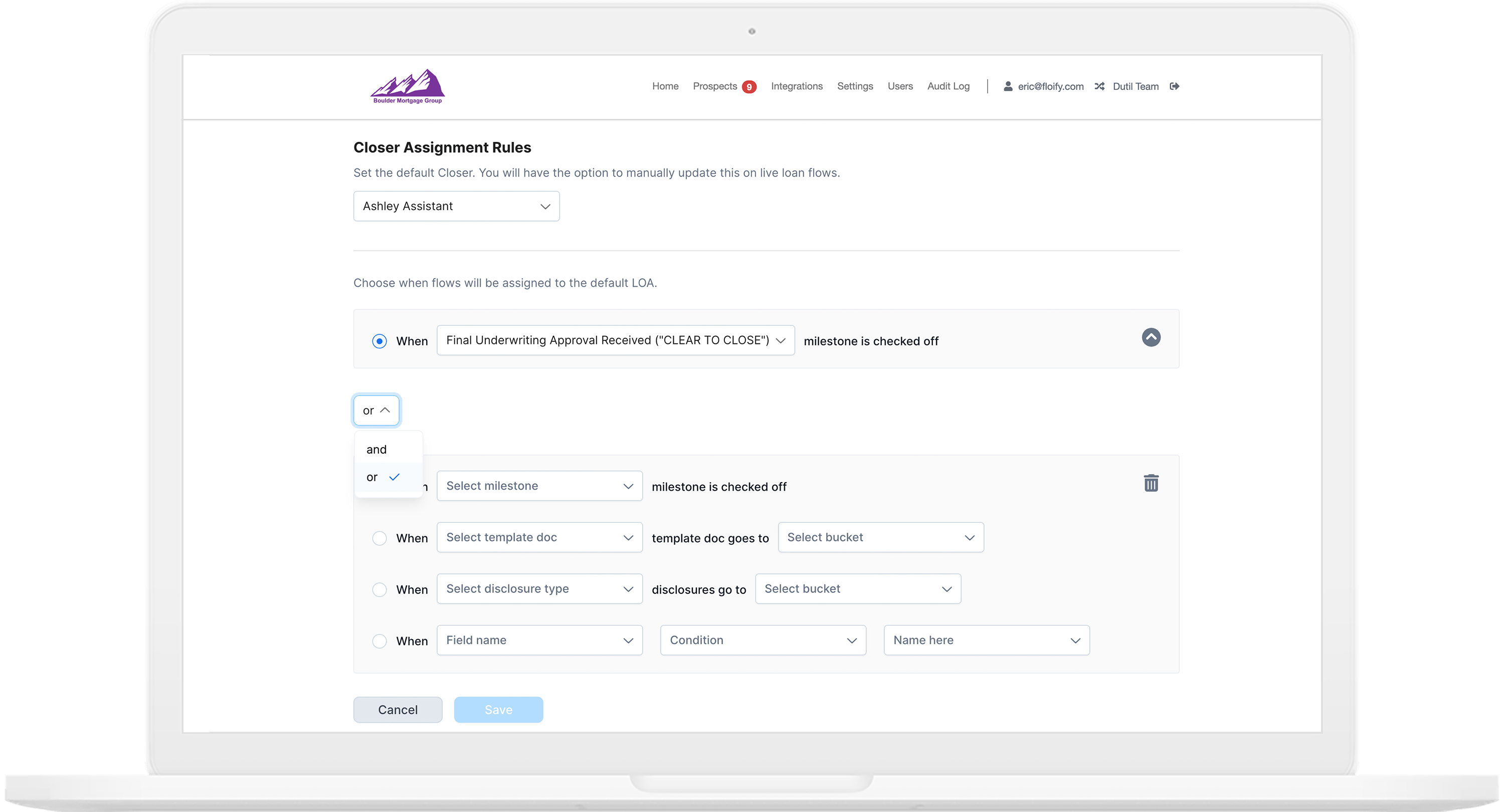

Floify's automated loan flow assignment functionality takes the efficiency gains of Task Management to the next-level by enabling managers to define business rules that govern exactly when a specified role will be assigned to a loan flow.

Teams are able to build multi-conditioned statements using AND/OR logic and tons of possible conditions to be as creative or precise as they want when crafting their assignment rules. The built-in flexibility makes it easy for teams to power an endless number of potential use cases, such as:

- When a loan flow is created, automatically assign to an LOA

- When the 1003 Application Completed milestone is checked off, automatically assign a Processor to the loan

- When a borrower's paystubs, credit report, and bank statements are at the Docs Pending Review status, automatically assign to an Underwriter

- When the Closing Disclosure is generated in the Docs Owed area, automatically assign a Closer

- When a custom LOS-synced "credit score" field is lower than 600, automatically assign to an Underwriter that specializes in low credit score borrowers

- When the Apply Now "loan type" field equals "refinance", automatically assign to a Processor that focuses on refinance files

By enabling automated loan flow assignment, origination teams and large scale lenders are able to remove a ton of wasted time from their support staff's workload, allowing them to stay laser-focused on the most valuable tasks of the day.

How to Get Started with Task Management in Floify

Task Management provides a huge efficiency boost, but it's also been made simple and intuitive to set up. In a few steps, managers can create user roles, assign those roles to specific users, and then start putting this feature to work by assigning users to loan flows manually or automatically with loan flow assignment rules.