BIG Features and Integrations – The Tale of Floify’s 2020

What… what actually just happened?

The world is writing the final pages of the book of 2020 and for most people, it probably feels like they just got spit out of the latest Stephen King novel. But the story for the mortgage industry was more like an action-packed survival book, full of challenges but also hidden treasures.

Mortgage professionals had to completely rethink and retool the way they did business amidst social distancing guidelines, on the fly, while handling an unprecedented refi boom.

Here at Floify, we saw it as our mission to build the functionality that our lender customers needed to adjust and thrive in this new reality. And build we did!

So, before we recharge our batteries, burn some sage, and dive straight into our 2021 plans, we wanted to take a few minutes to reflect back on the highlights (and there were a few) from Floify’s 2020.

(Just in case you missed them while frantically processing loans for months on end.)

BIG New Features and Functionality

Looking back, this was arguably one of the biggest years for new features that we’ve ever had at Floify. And the results speak for themselves.

Whether designed explicitly to boost workflow efficiency or with an obvious focus on improving the way loan teams and their borrowers interact digitally, we added some seriously impactful new features to the system this year.

Floify E-Sign

In a crowded field of awesome new features, Floify E-Sign stands out as one of the biggest and most impactful additions of the year.

A powerful, mobile-optimized feature designed for mortgage professionals and their processing teams, Floify E-Sign is included with Floify “out-of-the-box” and gives lenders and originators of all sizes an enterprise-grade eSignature solution to incorporate in their workflow.

Hybrid E-Closing

Hybrid E-Closing was built to help enterprise lenders who use Floify’s Disclosure Desk to cut as much as 75% of the time commitment from their borrower’s in-person closing appointment.

Hybrid E-Closing accomplishes this goal by empowering borrowers to electronically sign non-notarized portions of their closing package in advance of their actual closing appointment.

The result is a much more focused and efficient signing session in which only the absolute most necessary documents need to be addressed with a wet signature and all parties involved are in-and-out and on their way in minutes.

Automated Soft Credit Report Pulls

The addition of automated soft credit report fulfillment to Floify ensures that loan originators can access the important benefits of a soft credit report – initially qualifying a prospect for a lower upfront cost without opening the credit window for competitors – while maximizing their workflow with the efficiency-boosting power of Floify’s automation engine.

For time-crunched loan originators, this automation allows them to focus their efforts on initiating contact with the prospect, building the relationship, and securing the deal.

1003 Co-Pilot

More loans than ever are starting with an online application. However, not all borrowers are comfortable with technology and may struggle to get through even the most intuitive of loan applications.

Floify’s 1003 Co-Pilot feature helps loan originators provide these borrowers and prospects with live, on-screen assistance during the process of completing their loan application.

With Co-Pilot, LOs gain another powerful way to get complete applications into their pipeline faster and take their modern borrower experience to the next level.

Combined “One-View” Pipeline

Floify has long offered mortgage lenders and origination teams the flexibility to share important support staff, such as loan processors, between any number of branches or individual loan originator’s pipelines.

This makes it easy for companies big and small to maximize their capacity and take advantage of time and cost-saving efficiencies while only needing to expand their staffing when their organic growth demands it.

And now, with our one-view functionality, those critical employees can work even more effectively by viewing and accessing all loans that they support from a single consolidated dashboard.

Upgraded Audit Log

Floify’s Audit Log provides immediate visibility into over 100 different events that occur in the system, making it easy for company administrators to see who did what and when in Floify.

In addition to the enhanced tracking capabilities, mortgage professionals can also now search or filter their Audit Log by event type, user, loan, or date to easily and quickly find the exact information that they need.

Reporting & Analytics

Our recently released Reporting & Analytics dashboard makes it easier than ever for mortgage lenders to access and visualize their loan and borrower data.

Lenders can take advantage of the insights provided by their own data to find bottlenecks in their process, evaluate the performance of their loan production teams, or dig into the details of their typical borrower profile.

Arizona & Texas Forms Generator

Originators who do business in Arizona and Texas can leverage the advantages of Floify’s automation platform to speed up the creation and fulfillment of the pre-qualification forms that are specific to these states.

Not only will lenders save on time and frustration by using Floify’s AZ and TX form generator, but they will also maintain a cohesive loan experience by making the documents available for eSignature in the same secure web portal their borrowers know and trust.

Partnerships and Integrations

Similar to our feature roll above, the significant partnerships and integrations from the last 12 months are just hugely impactful for many lenders and loan originators.

And these are just the highlights!

Optimal Blue

Floify’s integration with Optimal Blue, now part of Black Knight, gives lenders the power to use existing 1003 data to run loan scenarios directly within the mobile-optimized Floify user interface.

From any device, anywhere, lenders can quickly search for up-to-date product and pricing to present their borrowers with accurate and timely loan information.

Surefire CRM

Lenders and originators that utilize Top of Mind’s Surefire CRM alongside Floify now have the ability to establish a flow of data between the two systems to unlock new possibilities for sales and marketing automation.

Once integrated, contact data from the submitted 1003 will automatically populate in Surefire. Milestones from Floify can also be mapped and synced to Surefire and can then be used to trigger custom rules and workflows within the CRM to automate follow-ups, marketing campaigns, task creation, and more.

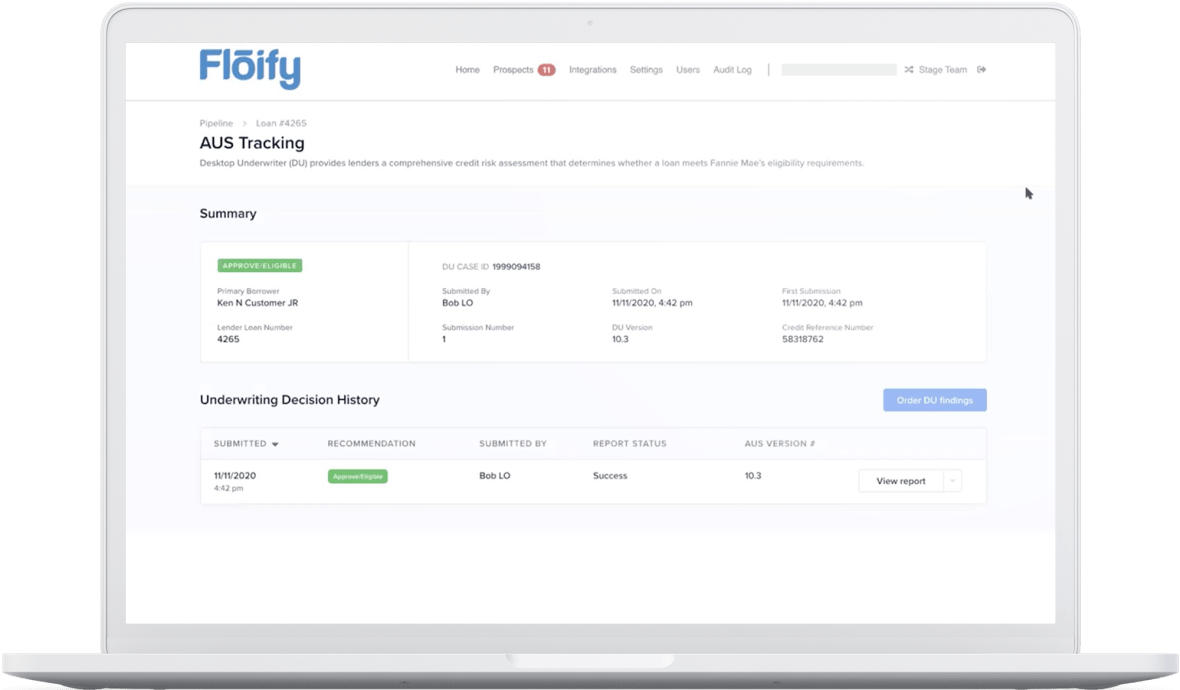

Desktop Underwriter®

Floify’s integration with Fannie Mae’s flagship automated underwriting system, Desktop Underwriter®.

Floify’s integration with DU® provides loan originators with the power to order findings on a loan flow, when used in conjunction with one of Floify’s enterprise-grade LOS integrations.

Additionally, the DU integration can be configured to instantly generate branded pre-qualification letters for prospects when a lender has also activated the Optimal Blue PPE integration as well as a credit integration.

LendingPad

Floify’s integration with popular LOS LendingPad streamlines two crucial components of a loan originator’s workflow by automating the flow of data between the lender’s loan origination system and point-of-sale.

First, Floify’s 1003 loan application will seamlessly synchronize its 3.2 data file to the LendingPad LOS – ensuring a flawless upload of the borrower’s critical application information.

Also, approved borrower documentation uploads will push directly into LendingPad from Floify. This enables loan originators to skip the entire process of stacking and sending documents from Floify before then uploading them to their LOS.

Sizing up Floify’s 2021

We’d be lying if we said that we’re looking forward to more 2020-style surprises in the New Year. But, either way, we’re prepared for whatever challenges the industry may face.

Our 2021 roadmap is already taking shape. There are more exciting new features and integrations planned, as well as improvements to the building blocks we’ve laid, such as Floify E-Sign and Reporting and Analytics.

We’re excited to get to work and serve you, our customers, in 2021 and the years to come.

Cheers to your success!