Informative Research

Seamlessly Integrated Credit Reporting

Floify's integration with the Informative Research credit reporting solution enables loan originators to quickly and easily get validated applicant credit information directly within Floify by leveraging the originator's existing Informative Research account.

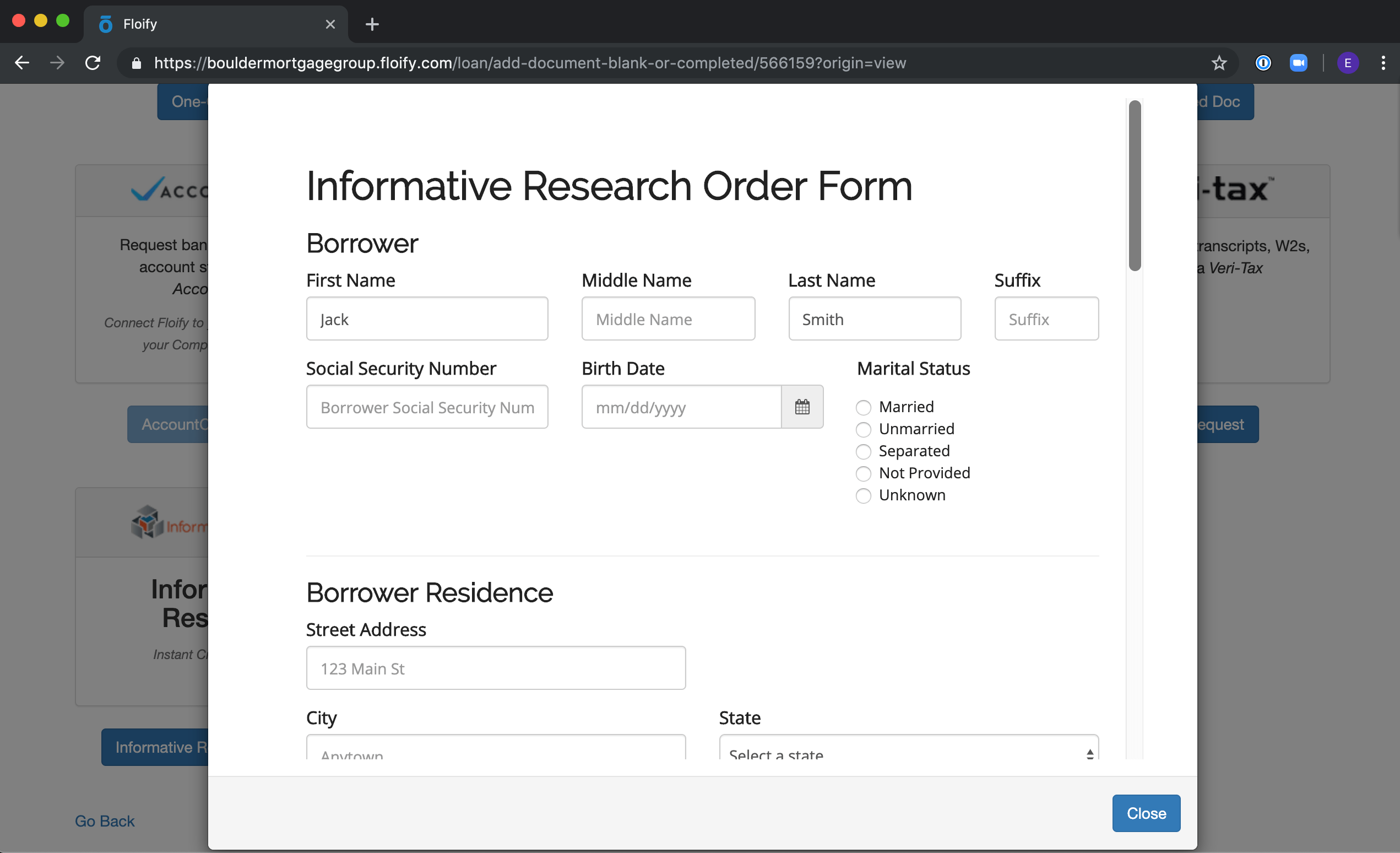

Setting up the integration in Floify requires just a single-click to enable, and then the originator's Informative Research account credentials are entered, and subsequently stored for future use, on the report order form.

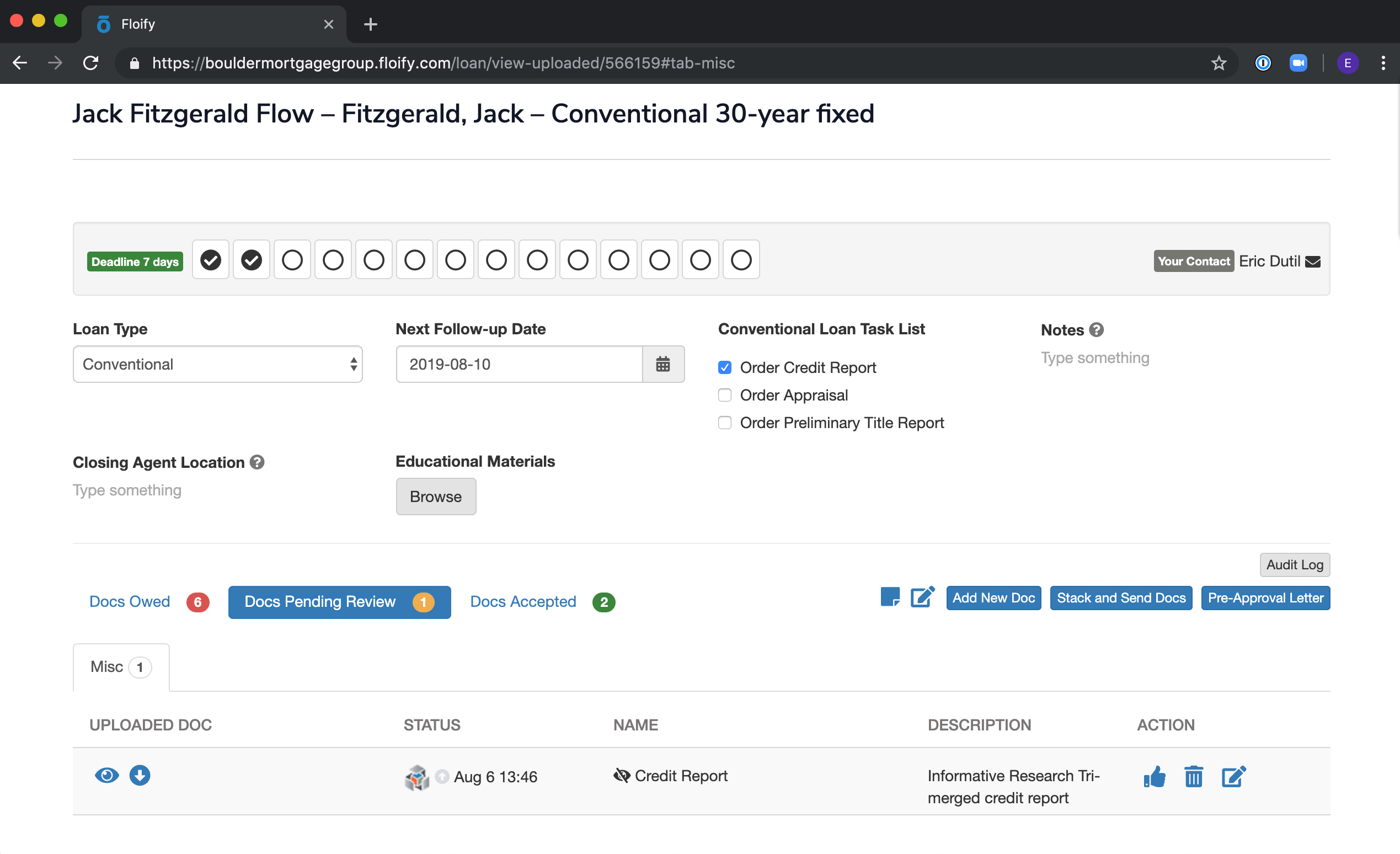

Once the integration setup is complete, a credit pull can be initiated on-demand from a Floify loan flow. Additionally, loan teams can configure the integration to automatically pull a borrower's hard or soft credit report upon the submission of a Floify 1003 loan application.

The Informative Research integration takes advantage of Floify's built-in credit authorization functionality, which empowers borrowers to digitally submit their consent to originators in just a few clicks.

After credit has been ordered, the full report will be delivered to the yellow bucket of the corresponding Floify loan flow within moments and is viewable only to the loan originator and lending team for processing.

About Informative Research

Informative Research is a fintech leader that offers lenders a wide range of solutions for each step in the loan cycle. Some of their solutions include the TriMerge Credit Report, Trended Credit Data, CreditXpert Solutions Suite, Flood Certifications, 4506-Ts, and their cost-effective SoftQual solution – which can save lenders up to 70% on credit report spend and helps prevent leads from getting poached. As the only company in their market space with 3 security certifications, IR is committed to protecting consumer data and the lenders’ process so you can maximize your time and profits.

Go to informativeresearch.com for more details on how you can simplify your success with one vendor, less fees, and better service.